Bermaui Pin Bars Or (BPB) is an indicator that finds Pin Bars price action pattern on the chart. Pin Bars is a shortcut for "Pinocchio Bars" which is a classic bar pattern alternative to Japanese candlesticks with tall upper or lower shadows and very small bodies like Hammer, Inverted-Hammer, Hanging Man, Shooting Star, Dragon Fly Doji or Grave Stone Doji 10/11/ · The Bitcoin market has initially tried to rally on Tuesday but gave back the gains to form a little bit of a shooting star. Ultimately, I think this is a market that will eventually find buyers though, and I think we are simply just running into a little bit of exhaustion as 18/10/ · The Forex markets are trying to pick and choose winners and losers, instead of just trading the US dollar homogenously like you typically will do. The Australian dollar rallied initially on Friday to break above the day EMA, but in the end only turned around to show signs of hesitation. The

Easy Trade - Trade the markets with a broker that's trusted by millions.

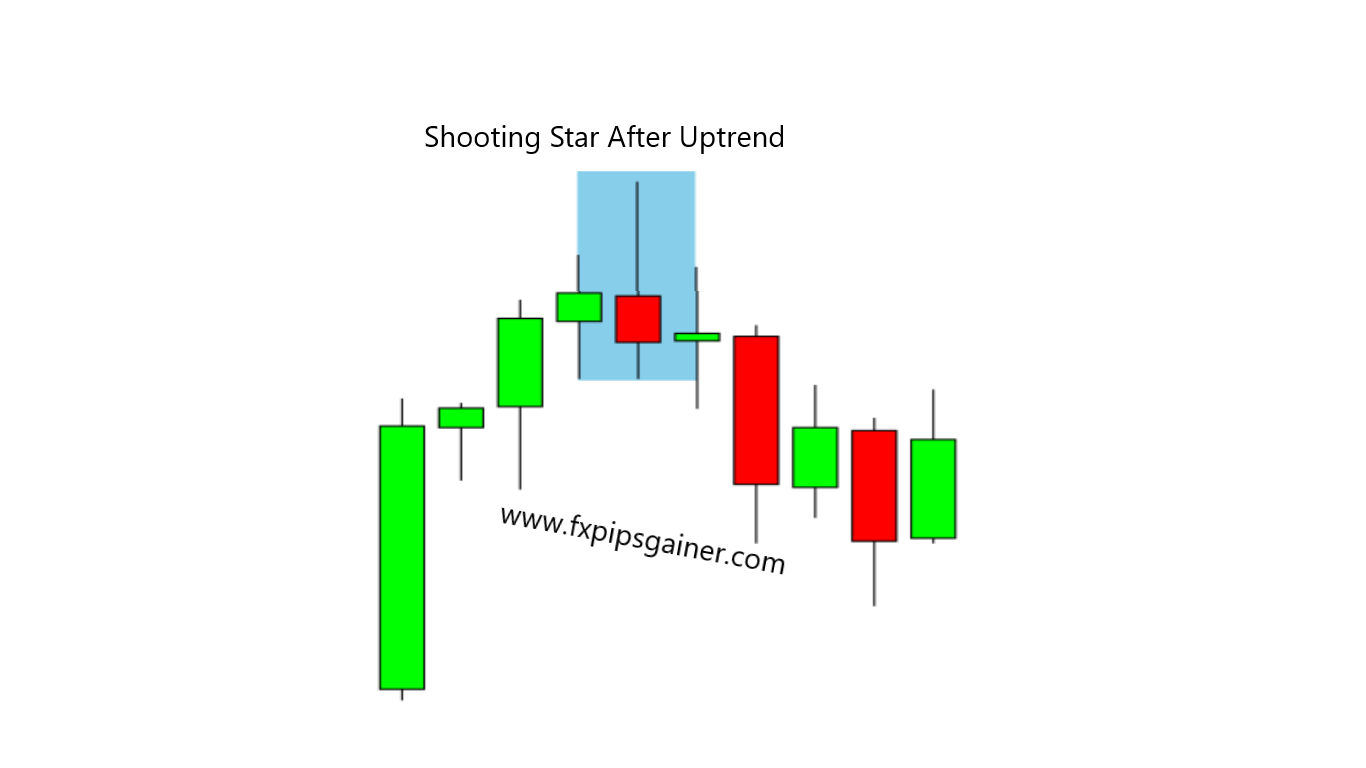

This candlestick guide focuses on how to find and interpret the shooting star candlestick pattern. Read on to find our example chart with a detailed explanation on how the shooting star can be seen. We also distinguish between the shooting star and inverted hammer candlestick pattern, sometimes referred to as an inverted shooting star.

The Shooting Star candlestick formation is viewed as a bearish reversal candlestick pattern that typically occurs at the top of uptrends. Also, shooting star in forex trading, there is a long upper shadow, generally defined as at least twice the length of the real body. The bearish shooting star is considered a stronger formation because the bears were able to reject the bulls completely plus the bears were able to push prices even more by closing below the opening price.

The Shooting Shooting star in forex trading formation is considered less bearish, but nevertheless bearish when the open and low are roughly the same. Alternatively, you can see our stock trading guide. The bears were able to counteract the bulls, but were not able to bring the price back to the price at the open. The long upper shadow of the Shooting Star implies that the market tested to find where resistance and supply was located.

When the market found the area of resistance, the highs of the day, shooting star in forex trading, bears began to push prices lower, ending the day near the opening price. The chart below of Cisco Systems CSCO illustrates a Shooting Star reversal pattern after an uptrend:. In the CSCO chart above, the market began shooting star in forex trading day testing to find where supply would enter the market.

In fact, there was so much resistance and subsequent selling pressure, that prices were able to close the shooting star in forex trading significantly lower than the open, a very bearish sign. The Shooting Star is a candlestick pattern to help traders visually see where resistance and supply is located.

After an uptrend, the Shooting Star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited.

However, other indicators should be used in conjunction with the Shooting Star candlestick pattern to determine potential sell signals. For example, shooting star in forex trading, waiting a day to see if prices continued falling or other chart indications such as a break of an upward trendline.

For aggressive traders, the Shooting Star pattern illustrated below could potentially be used as a sell signal. The red portion of the candle the difference between the open and close was so large with CSCO, that it could be considered the same as a bearish candle occurring on the next day. However, caution would have to be used because the close of the Shooting Star rested right at the uptrend support line for Cisco Systems.

Generally speaking though, a trader would wait for a confirmation candle before entering. The bullish version of the Shooting Star formation is the Inverted Hammer formation that occurs at bottoms. Another similar candlestick pattern in look and interpretation to the Shooting Star pattern is the Gravestone Doji, shooting star in forex trading.

If you are interested in trading using technical analysishave a look at our reviews of our recommended brokers to learn which tools they offer. The below brokers are regulated to operate in :. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The shooting star candle stick pattern is a beneficial technical analysis tool to notice a bearish divergence in the market.

The shooting star indicator may be useful for traders gone short on a market looking for an exit, or traders looking for an entry point to go long. If the open, low, and closing prices are almost the same, you can see a shooting star formation that, often interpreted by traders as a sign for a bearish move. In forex, the shooting star pattern shows like in any other chart.

The candlestick for your chosen forex currency pair would open, close, and find a low at similar price points. The inverted shooting star is a bullish analysis tool, looking to notice market divergence from a previously bearish trend to a bullish rally. An inverted shooting star pattern is more commonly known as an inverted hammer candlestick, shooting star in forex trading. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting star.

Skip to content. Disclosure: Your support helps keep Commodity. com running! Learn more Contents What Is The Shooting Star Candlestick? How to Interpret Shooting Star Candlestick Patterns Is There A Bullish Shooting Star Pattern? Where Can I Trade Commodities?

FAQs Further Reading. Loading table Plus is not available in the US Legitimate CFD brokers, like Plus, cannot accept US clients by law.

How to trade SHOOTING STAR Candelstick Pattern

, time: 10:41Patterns For Day Trading - Best Chart And Candlestick Signals For Trades

10/11/ · The Bitcoin market has initially tried to rally on Tuesday but gave back the gains to form a little bit of a shooting star. Ultimately, I think this is a market that will eventually find buyers though, and I think we are simply just running into a little bit of exhaustion as Chart patterns form a key part of day trading. Candlestick and other charts produce frequent signals that cut through price action “noise”. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs Finally!! A broker that makes trading so easy that even your grandma would want to start! Trading doesn’t have to be hard. All it takes is 15 seconds to open an account and 5 minutes to see how easy it is to start trading for profits with EasyTrade

No comments:

Post a Comment