Because of this, leverage trading is more prevalent in forex trading compared to other financial instruments. Leverage is the magnifying lens you need in trading that allows you to open bigger trading positions that your funds might not be capable of holding. Leverage incurs an expensive risk profit 08/02/ · What is leverage in forex trading? Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment (deposit).Estimated Reading Time: 4 mins The first and by some way most important benefit of trading on leverage is that it earns you more money for less effort. Leverage is effectively just a short-term, notional loan. It is notional in the sense that you don’t physically receive a loan – it’s simply an automatic credit line extended by your broker in respect of your forex trades

How Leverage Works in the Forex Market

New to PrimeFin? Open account. Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read full Risk Disclosure Statement. Enter you is leverage automatic in forex trading address and we'll send you a link to reset your password. Remember your password? GO TO LOGIN. Live up to the market pace with timely updates, financial insights, instant price change signals and investment ideas from PrimeFin, is leverage automatic in forex trading.

We can't wait to talk to you. But first, please take a couple of moments to tell us a bit about yourself. Return to list Leverage Trading in Forex — The possibility of trading leverage. If you are a new trader in the forex market, you might be puzzled by leverage in forex trading and how useful it can be for traders.

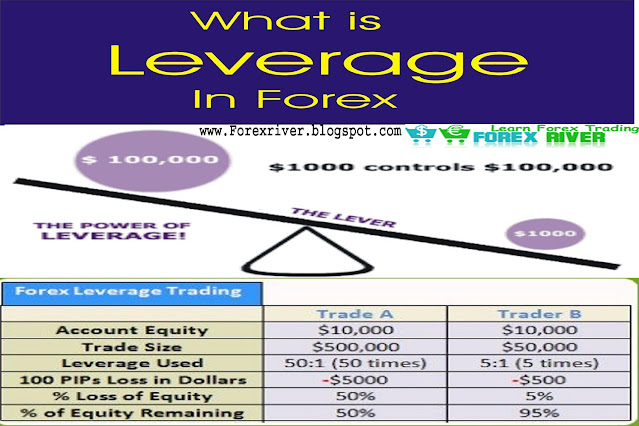

If you find yourself in such a situation, here is detailed content on what leverage trading is all about, the advantages and disadvantages. Generally, leverage allows you to influence your trading amount without increasing your trading capital. In trading, it refers to accessing a larger portion of the market with smaller funds. Unlike traditional investment, where you must have physical funds, leveraged forex trading allows you to trade without any physical cash to open a bigger lot.

Today, leverage trading is a widely accepted concept and strategy a lot of traders use in trading. Corporations and institutional traders have the financial capability to open bigger trades that might take decades to open.

However, brokers have simplified the process to allow retail traders to open trades beyond their initial capital. You can see leverage as a short-term loan a trader takes from his or her broker, allowing such an individual to open a big lot with small capital. However, your broker provides the needed funds for you to trade with your little amount.

Leverage gives you protection against exposing your capital, as the case is when using However, it allows trading at different percentages of your exposed capital; then, you return the leveraged amount once you close the transaction.

It means that you keep the profit for every position while bearing the high risk of losing your trading investment if the market goes against your trading position. You decide to open a buy position with the currency pair EURUSD with a volume of 10, Then the price you opened the trade is 1. Your forex margin requirement for this currency pair would be the price multiplied by the volume and the leverage ratio.

Most brokers offer a calculator as one of the numerous tools traders can use in trading forex. Furthermore, if you decide not to use a stop-loss, you will incur more losses, and your account can liquidate depending on your capital. Stop-loss is one of the best risk management tools to mitigate your risks when trade forex. In comparison, some derivatives might allow you to use a leverage level around is leverage automatic in forex trading is different in forex trading.

Trading leverage ratios in forex can be in depending on the forex broker. Because of this, leverage trading is more prevalent in forex trading compared to other financial instruments. Leverage is the magnifying lens you need in trading that allows you to open bigger trading positions that your funds might not be capable of holding. Leverage incurs an expensive risk profit. However, when appropriately used, it can be a useful companion in forex trading. At times, traders tend to confuse the difference between margin trading and leverage trading.

For some, they refer to the same thing. However, the margin is leverage automatic in forex trading an essential concept to is leverage automatic in forex trading if you want to take your trading seriously. Margin is the amount of money you require to place or open trade and maintain that position before closing it.

It is not a transactional cost you pay but a security deposit the broker holds for open trades. However, leverage allows you to trade large position sizes using a small amount of money. For instance, if you have a leverage ratio ofit means you can control trade that is 50 times your initial investment, is leverage automatic in forex trading. Leverage trading is a key component of financial derivatives trading, including CFDs trading and spread betting.

You can use leverage on different asset classes, including commodities, indices, stocks, and CFDs. Remember, CFDs are complex financial instruments that have a lot of risks. While leverage trading is a double-edged sword, it can offers benefits return is leverage automatic in forex trading forex traders who understand how to use it to their advantage. Leverage may create numerous advantages for any trader that can tame the wild beast of using it but can also be equally risky and make a trader end up losing.

Increased Profit. Whether you open a buy or sell position, the primary purpose of that decision is to gain profit. Leveraged trading could allow you to earn more while investing a little capital. However, it can also be risky with making you lose everything, is leverage automatic in forex trading. Irrespective of the instrument you trade, whether you are taking a large or little amount, the primary intention is to increase your profit from every trading position by multiplying the stakes.

You may also get the same result if you invest more funds or money. However, is leverage automatic in forex trading, with leverage, is leverage automatic in forex trading, you can go a step ahead as you artificially boost your available trading capital without adding any money to it, is leverage automatic in forex trading.

Leverage helps increase your trading funds by many hundreds of times. Ultimately, traders in the forex market leverage to trade with lesser capital. It is all about raising their stakes to get more potential profit on the invested little capital in the forex markets. Increased capital efficiency. While leverage in forex can increase the amount of money invested, it can also increase your capital efficiency and so the risk too.

To understand how that works, see your capital as an asset that can deliver a yield. It means you can reinvest that capital and make a profit over time. Mitigation against low volatility. Leveraged trading in forex helps in mitigating against low volatility. Trades that usually produce a high amount of profit are the volatile ones since the forex market moves in broader cycles than stable instruments.

Because forex traders are cautious when trading currency pairs and the different factors that can affect price changes, volatility is usually low at the end of the scale. Here is where leverage can become an advantage by allowing you is leverage automatic in forex trading make bigger potential profits from smaller trading positions. However, is leverage automatic in forex trading, it is equally risky and may end up making you loss everything.

With a high leverage position, a small price change can make a huge difference as traders do everything to capitalize on these currency movements. Leverage is indeed a double-edged sword because when it is working, everything goes your way. However, it comes with a high risk of losing within the twinkle of the eyes. Despite the many benefits of leverage in forex, most traders face problems when they unsuccessfully dabble in forex leverage without understanding it.

Most traders get greedy even with their little capital and make critical mistakes that will affect their trading. Leverage can work in both directions if wrongly managed. Heavier losses. With a minimum 0. Therefore, forex trading leverage can result in losing more than you expected, but you can also make higher potential profits if you can bear the losses. Constant liability.

Once you leverage your forex account, it is an immediate liability because there are additional costs you must pay whether the market goes up or down. You have to meet the principal cost of the leverage. The charges apply automatically from your trading account. Financing Costs. The interest is calculated and is applicable daily depending on what your forex broker sets. These costs are applicable when you use high leverage in forex positions; regrettably, the costs can accumulate to act as an impediment when holding long-term trades.

Margin Call Risk. The margin number is a set percentage for any position size you need to fulfill in your trading capital. However, if you fall below the required threshold, your broker will initiate a margin call on your account. Once that happens, your broker will automatically liquidate your portfolio if the funds cannot hold your trade.

When this happens, positions that would have run on profit are closed along with other liquidating positions. Eventually, margin trading is a constant risk due to leverage, which can affect your trading balance. PrimeFin allows traders to use leverage in the forex markets.

Furthermore, leverage trading is also permitted in other financial instruments but limited to some assets. Remember using leverage has its demerit. You should consider the risk before leverage trading. PrimeFin has the quality trading tools for you to start your trading. To begin, you can follow the steps below:.

Sign up for a trading account Fund your account Start trading. PrimeFin is one of the leading forex exchange platforms that allows you to trade different tradable assets in the financial market.

What Leverage should I use when Forex Trading? Leverage EXPLAINED!

, time: 8:37What Is Leverage And How To Use It In Forex Trading | blogger.com

28/07/ · Note that in Forex indices trading, the leverage does not matter, since it does not take part in the margin calculation formula. The so-called margin percentage is considered here. The margin percentage is set by the broker for each index. The percentage depends on the liquidity provider. The position amount is corrected by this blogger.com: Oleg Tkachenko 08/02/ · What is leverage in forex trading? Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment (deposit).Estimated Reading Time: 4 mins Instead of transacting at % of your exposed capital, as is always the case when trading , leverage enables trading at many thousands of percent of your exposed capital, on the proviso that you return the leveraged portion when the transaction closes. Don’t worry – this is blogger.comted Reading Time: 10 mins

No comments:

Post a Comment