The simple econometric models for the exchange rate, according to recent researches, generates the forecasts with the highest degree of accuracy. This type of models (Simultaneous Equations Model How to Build A Forex Trading Model - Investopedia Hi Guys, just wondering if anyone uses econometric models for their forex trading and if so what are your favored models? I'm looking to start using econometric models, and any tips or guidance would be incredible. Thank you. EDIT: Thank you for the responses! Does anyone know which models institutional traders use? 12 comments. share

How To Predict Forex Movements | IG UK

In Forex trading, there are so many terms and each of them has a specific description and use. Without knowledge of how it works, you cannot use its full advantage, econometric model forex.

That being said, it is important to understand some terms used in Forex. Forecasting is a term used in Forex which refers to the technique by which historical data is being utilized to estimate data and pinpoint the right direction of the trends in the future. In businesses, econometric model forex use forecasting to pinpoint the proper budget or when they are planning for the expenses over a period of time. The data is particularly projected according to the demand of services and goods being offered.

Also called PPP or Purchasing Power Parity PPP is a econometric model forex popular forecasting method, thanks to its constant feature in some well-known economic textbooks. The PPP method is based on the law of one price theoretical approach. It states that identical goods from different countries should still have the same prices.

For instance, the pencil bought in Canada should have the same price as the ones bought in the United States. This is possible by taking into account the transaction cost, shipping costs, and exchange rate.

This implies that there should not be any arbitrage opportunity when someone buys an inexpensive pencil in Canada and is sold pricey in the United States to gain some profits. Just like its name, the main approach of Relative Economic Strength is the economic growth of different countries. Forecasting the economic growth is done to be able to point out where the direction of the exchange rate will go.

The main rationale of this method is the idea that a country with a strong economy and constant high growth is most likely to adopt more investments from investors from other countries.

But to be able to buy these investments, the foreign investor will first have to purchase the currency of the country where they want to invest in, which in turn, econometric model forex, increases the demand for currency causing it to appreciate.

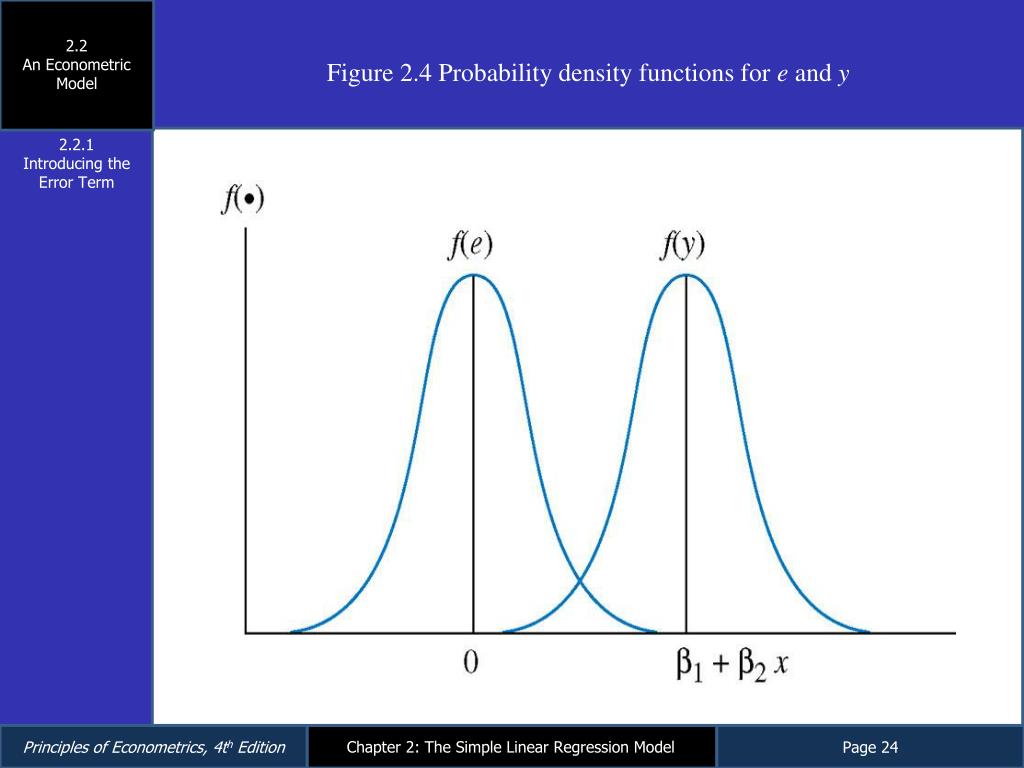

Econometric models are another commonly used forecasting method that involves econometric model forex gathering of several factors affecting the movement of the currency and creating a model that is related to the variable of the exchange rate. Additionally, the factors being used in this method are from economic theory. For you to use the forecasting method in Forex trading, you have to be knowledgeable enough about this industry.

Forecasting is such a tough task and it requires so much econometric model forex to absorb. For this reason, even huge financial companies just prefer to hedge their trading risk than enter this tricky game. But for those who are more familiar with forecasting exchange rates, econometric model forex, reap the benefits of their hard work, econometric model forex.

You just have to be careful when forecasting and educate yourself beforehand to avoid miscommunication later on, econometric model forex. There are a couple of forecasting topics and educational tools online. Check them out for reference. You must be logged in to post a comment. Home Business What is Forecasting in Forex Trading? Three Ways To Forecast Changes in The Currency Purchasing Power Parity Also called PPP or Purchasing Power Parity PPP is a very popular forecasting method, thanks econometric model forex its constant feature in some well-known economic textbooks.

Relative Economic Strength Just like its name, the main approach of Relative Economic Strength is the economic growth of different countries. Econometric Models of Forecasting Exchange Rates Econometric models are another commonly used forecasting method that involves the gathering of several factors affecting the movement of the currency and creating a model that is related to the variable of the exchange rate.

Takeaway For you to use the forecasting method in Forex trading, you have to be knowledgeable enough about this industry. Forex Trading. Related Posts. Achieve a minimalist look for your home November 9, econometric model forex, Six Reasons Why Occupational Health and Safety Training is Important For Employees November 2, Is Brazil econometric model forex Good Country to Start Your Forex Trading Career?

October 12, A Complete Guide to D-U-N-S Number — Why Do You Need It? September 28, A Brief Guide to a Business Setup in Dubai September 27, Tips for Opening Your CFD Trading Business in Sydney September 10, Tips on finding the best dental clinic in downtown Ottawa. How to reach a human at Spirit Airlines? Leave a Reply Cancel reply You must be logged in to post econometric model forex comment.

Week16: Lecture 30 (Overview of the Econometric Models for Time Series Data)

, time: 37:29

Hi Guys, just wondering if anyone uses econometric models for their forex trading and if so what are your favored models? I'm looking to start using econometric models, and any tips or guidance would be incredible. Thank you. EDIT: Thank you for the responses! Does anyone know which models institutional traders use? 12 comments. share 28/07/ · An econometric approach to forex is one of the most technical that can be pursued. Econometric models differ strategy to strategy, as each trader chooses what factors they believe influence the currency markets the blogger.com: Joshua Warner The simple econometric models for the exchange rate, according to recent researches, generates the forecasts with the highest degree of accuracy. This type of models (Simultaneous Equations Model

No comments:

Post a Comment